- Home

- Services

- Meet the Team

- Help & Advice

- Useful information

- Companies

- Expenses for directors

- Travel

- Car Benefit

- Buying or Leasing

- Closing a Trading Company

- Capital Distributions on Winding Up

- Non-Trade Income

- Cash Surplus on Balance Sheet and Effect on Trading Status

- Trading Company – Definition

- Company Losses

- Share Structure

- Selling Assets to the New Company

- Super-Deduction

- Payroll

- Penalties

- The Contract Employment Status Tool (CEST)

- The Employment Status Indicator (ESI)

- Benefit in Kind

- Construction Industry Scheme (CIS)

- VAT

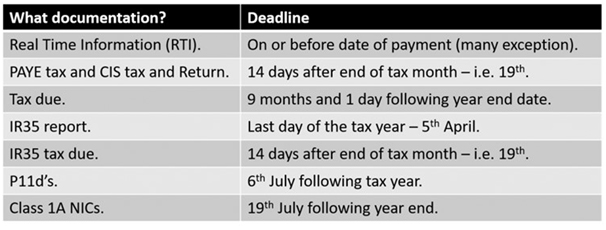

- Deadlines

- Penalties

- Deductible Expenditure

- Disallowable Expenditure

- What is Making Tax Digital (MTD)?

- Place of Supply: Goods

- Accounts

- Cash Basis

- Accruals Basis

- Expenses you can claim Entertaining And Gifts To Employees\Directors

- Entertaining

- Gifts Over £50 to Staff

- Gifts to Customers and Suppliers

- Free Food and Drink

- Staff Meetings and Training

- Motor Expenses

- Interest on Car Loans

- Mileage

- Actual Costs – Running Expenses

- Buying or Leasing

- Ownership

- Vans

- Travel

- Accommodation

- Subsistence (Food and Drink)

- What Can I Claim For “Use Of Home”

- Gifts And Donations

- Rental & Holiday Lettings

- Trading And Property Allowances

- What is a Furnished Holiday Letting (FHL)?

- Property Ownership

- Unmarried Owners

- Married Couples and Civil Partners – Joint Ownership

- Partnership

- Keeping Records

- Expenses

- Capital Outgoings and Recent Changes

- Capital Gains

- Repairs/Capital improvements

- Capital Gain

- Pay Capital Gains Tax in 30 Days

- Here are Some Terms you should be Aware of

- Entrepreneurs’ Relief (ER)

- Separation

- Contact

Help & Advice

Expenses for directors

Travel

There is no relief available on the cost of home-to-work travel unless it is to a temporary workplace, or home is a workplace. Directors perform many different duties so whether a home qualifies as a workplace in relation to an individual director will depend on the facts of each case.

When a director has to travel between different sites or appointments etc the cost of travel and incidental costs (subsistence, accommodation and incidental overnight costs) will also qualify for tax relief.

The cost of some triangular travel where the journey is from home via a temporary workplace may be allowable.

Car benefit

Where an employer provides a higher paid employee, or a director with a company car, a taxable benefit arises. The amount of the benefit is determined by the cost, CO2 emissions and power supply. The benefit is reduced when a vehicle is not made available for part of the tax year. Pooled cars can be provided tax-free while the charge on low emission vehicles can be very low.A further benefit arises if fuel is supplied for private use. It is unlikely to be tax efficient to supply private fuel.

Car benefit is calculated as a percentage of the manufacturer’s list price of the car plus accessories, based on the carbon dioxide (CO2) emissions of the car as follows:

• Take the list price of the car.

• Add the price of any accessories

Deduct any capital contributions made by the employee toward the cost of the car or accessories. This is the “interim sum”.

• Multiply the interim sum by theappropriate percentage (this is worked out according to the car’s CO2 emissions with adjustments for fuel type).

• Reduce for periods when the car is unavailable or shared

• Deduct payments made* by the employee for private use of the car.

Note

• If the car is a classic car with a market value of more than £15,000 the rules are changed.

• There are special rules for cars that have very low emissions/run on dual/alternative fuels.

• The appropriate percentage changes each year.

• The employer pays Class 1A NICs too, but this along with all the running costs and capital allowances, are tax deductible.

The Revenue’s company car and fuel benefit calculator can be accessed here.

https://www.gov.uk/expenses-and-benefits-electric-company-cars

Buying or leasing

For a cash purchase the company can claim capital allowances based on CO2 emissions. If HP is used a similar deduction is available and the finance costs can be claimed. For an operating lease the rental payments can be claimed subject to a possible restriction depending on CO2. For some qualifying cars 50% of the VAT can be claimed.

Closing a trading company

On closing a trading company, the net asset will be released back to the shareholders. This can be done through an informal striking off or a full liquidation. The Revenue’s notes on this can be found here.https://www.gov.uk/topic/company-registration-filing/closing-company

Striking off is very simple and requires the submission of a form (DS01) to Companies House with £10.https://www.gov.uk/government/publications/strike-off-a-company-from-the-register-ds01

Capital distributions on winding up

From 6 April 2016 there are restrictions on treating the final distribution as capital.

• The shareholder must have held at least a 5% interest in the company before the winding up.

• The company has to be a close company.

• In the following two years, the shareholder must not be involved, directly or indirectly, in a similar trade or activity.

• The distribution must not be part of arrangement to avoid tax.

• Where the capital distributed following the striking off exceeds £25,000 it is all treated as income.

• While a formal liquidation is more expensive, all of the distributions are deemed to be capital and potentially qualifies for ER.

Non-trade income

A company’s trading status is considered by looking at all its activities and circumstances.

Investment businesses, such as property rental businesses are often unlikely to meet HMRC’s conditions. A company or business is not regarded as trading if it has substantial non-trading activities. HMRC will look at income from non-trading activities, asset held and how they are used, expenses incurred by employees and the company’s history.

Where investment or non-trading activities are more than about 20% of all activities then a company is “not wholly” trading. Ex-trading premises and rental income may also cause problems.

Cash Surplus on balance sheet and effect on trading status

Trading company – definition

This is a company carrying on trading activities which does not include ‘to a substantial extent activities other than trading activities.’

Non-trading activities may include investment in property, share portfolios, bonds etc.

Excess cash deposits may point to a non-trading activity. Where cash is being accumulated for future use in the trade then the company will be classed as trading.

HMRC use the phrase ‘substantial extent’ by which they mean more than 20%. They apply the 20% test to:

Turnover – does investment income exceed 20% of total turnover?

Balance sheet – are more than 20% of the assets of the company held as investments?

Expenses – do more than 20% of the expenses relate to non-trading expenses?

Directors’ time – do the directors spent more than 20% of the time managing non trading activities.

Cash held on deposit may not involve much ‘activity’ in managing it and this can also indicate trading.

Where the cash surplus arises from the sale of a trade or business assets prior to liquidation then ER can still be claimed but the distributions must be made within 3 years of the sale of the assets. .

Company losses

If your company or organisation is liable for Corporation Tax and makes a loss from trading, the sale or disposal of a capital asset, or on property income, then you may be able to claim relief from Corporation Tax.

You get tax relief by offsetting the loss against your other gains or profits of your business in the same accounting period. You can also choose to carry the loss back, if you do not it will be carried forward to another accounting period.

https://www.gov.uk/guidance/corporation-tax-calculating-and-claiming-a-loss

Share structure

Share capital is the total nominal value of the shares in the company, such that a company with 100 ordinary £1 shares will have a nominal share capital of £100. This is not the same as what the shares are worth, which will depend on the value of the company. The company can issue different types of shares. Normally, a small company will issue ordinary shares and may choose to have different classes of ordinary shares (such as A ordinary shares, B ordinary shares, etc.). This structure, known as an alphabet share structure, is a popular structure, as it allows for different dividends to be declared in respect of different classes of shares, which can be very useful from a tax planning perspective. The company can also choose to give different rights to different classes of shares too. For example, the parents may have full voting rights, whereas children may be given shares with an entitlement to dividends only. However, where shares have restricted rights, this may compromise the availability of business asset disposal relief if the company is sold.

Practical tip Consider what share structure will work best for your family company, what rights you want individual family members to have and what flexibilities you wish to retain. Setting up an alphabet share structure at the outset preserves flexibility. However, when assigning rights and shareholdings, be mindful of the qualifying conditions for business asset disposal relief. The company could also issue preference shares, which have a fixed right to dividends and no voting rights, although these are less common in a simple family company. As well as deciding on the type of shares, the family needs to decide how many shares to issue and to whom. The authorised share capital places a limit on the number of shares that can be issued. The company does not need to issue all the shares that can potentially be issued – the shares that are issued form the issued share capital. The company can decide how many shares to issue, as long as this is within the authorised share capital. In a simple family company where there are only two shareholders, such as a husband and wife or civil partners, the company could simply issue one share each. This approach could be adopted whether they simply have one class of ordinary share or adopt an alphabet share structure. Alternatively, the company could issue 100 shares of each class, as this provides for an element of flexibility in holdings of a particular type of share, and this approach is often adopted by small companies. It should be noted that the shareholders must pay for their shares and, in doing so, introduce capital into the company. The amount of capital that the family wish to introduce will have a bearing on the number, class, and nominal value of the shares that are issued

Selling assets to the new company

Assets are items or property of an enduring nature that are not consumed within a year and usually cost over £100. They include computer equipment, furniture, tools, vehicles, etc.

Sell personal assets to the new company at market value. At the outset, the company will probably not have the funds available to pay the sole trader for the assets. However, assuming that the sole trader becomes a director of the company, this can be overcome by creating a debt from the company to the sole trader (in the form of a balance on the director’s account), which can be cleared when the company has the funds to do so. For capital gains tax purposes, the assets will be treated as being disposed of by the sole trader at market value, and this may give rise to a capital gains tax liability. Where the assets are transferred to the new company in exchange for shares, incorporation relief may be available.

Super-deduction

For expenditure incurred in a limited window, companies are able to benefit from a super-deduction. The super-deduction is available for new qualifying plant and machinery that would otherwise benefit from a writing down allowance at the main rate of 18%. However, cars do not qualify for the superdeduction. Further, the super-deduction is only available for investment in new assets; investment in second-hand assets does not qualify. The super-deduction is given as a first-year allowance at the rate of 130%. This means that where the super-deduction is claimed, the company is able to deduct a first-year capital allowance of £130 for every £100 of qualifying expenditure in calculating the taxable profits for the accounting period in which the expenditure was incurred. This will save corporation tax of £24.70 for every £100 invested in new qualifying assets (19% x £100 x 130%). To qualify for the super-deduction, the company must incur the expenditure on qualifying new plant and machinery between 1 April 2021 and 31 March 2023. A balancing charge may arise on the disposal of an asset that has benefited from the super-deduction. The calculation of the balancing charge will depend on when the disposal takes place.

Payroll

Penalties

What you pay depends on how many employees you have.

Number of employees | Monthly penalty |

1 to 9 | £100 |

10 to 49 | £200 |

50 to 249 | £300 |

250 or more | £400 |

The Contract Employment Status Tool (CEST)

HMRC have now produced a “Contract employment status tool” which gives their view on whether an engagement falls within IR35.

HMRC have stated that they will stand by the result you get from this tool provided:

• the information you have given is accurate and

• the results are not achieved through contrived arrangements, designed to get a particular outcome from the service.

If the information is checked and found to be inaccurate or contrived, they will be treated as deliberate non-compliance, and may attract penalties.

The Employment Status Indicator (ESI)

This is another step in the right direction taken by the HMRC to help taxpayers. According to the HMRC web site, completing the ESI tool will provide an indication of your employment status. Click here to try out the ESI tool.

The answer can be relied upon as evidence to support your position, provided your answers to the ESI questions accurately reflect the terms and conditions (not just the written contract) under which you provide your service and the ESI has been completed by your engager. If you just complete the ESI tool the result is only indicative.

https://www.gov.uk/guidance/check-employment-status-for-tax

Benefit in Kind

The provision of benefits-in-kind can form part of a tax-efficient profit extraction strategy. Providing benefits to employees who are not family members can be useful to generate goodwill, and where an exemption is available can be particularly tax efficient. However, the provision of benefits-in-kind imposes a number of compliance obligations on the family company. Where the benefit is taxable, unless the benefit is living accommodation or an employment-related loan, the employer can opt to deal with the tax on the benefit through the payroll (‘payrolling’). However, this is only an option if the employer signs up to payroll the benefit before the start of the tax year, as HMRC does not accept requests to payroll in the year. Once a benefit has been registered for payrolling, it remains registered unless cancelled by the employer. Again, this must be done before the start of the tax year for which the cancellation is to have effect. Employees must be given details of their payrolled benefits for a tax year no later than 31 May following the end of the tax year.

If taxable benefits are provided to employees and these are not payrolled (or included within a PAYE Settlement Agreement), the employer must report the taxable benefits provided to each employee to HMRC on form P11D by 6 July following the end of the tax year for which the benefits were provided (so, by 6 July 2022 for taxable benefits provided in the 2021/22 tax year). The employee must be given details of the benefits returned on their P11D or a copy of their P11D by the same date. A Class 1A National Insurance liability arises in respect of most taxable benefits provided to employees, which are not dealt with by means of a PAYE Settlement Agreement. The Class 1A liability is an employer-only liability payable at the Class 1A rate of 13.8%. Employers who have provided taxable benefits to employees must file a P11D(b) by 6 July after the end of the tax year. This is the employer’s declaration that all required P11Ds have been filed and also the statutory Class 1A National Insurance return. A P11D(b) is required even if there are no P11Ds to submit because all taxable benefits have been payrolled.

The general rule is that benefits are valued based on the cost to the employer. There are also specific rules for certain types of expenses.

https://www.gov.uk/guidance/payrolling-tax-employees-benefits-and-expenses-through-your-payroll

Cars – The benefit on company cars is dependent CO2 emissions and the list price. Where private fuel is paid for there is a fuel benefit. If the employee’s own car is used for employment purposes (not commuting) then they can be reimbursed at the Revenue’s suggested rates.

Where the reimbursement is greater than these rates a benefit will arise. If less then the employee can claim the difference as an expense.

https://www.gov.uk/government/publications/rates-and-allowances-travel-mileage-and-fuel-allowances/travel-mileage-and-fuel-rates-and-allowances

Trivial Benefits – Where benefits meet the definition of ‘trivial’ they can be excluded from the P11D, however, there is an annual cap of £300 on this exemption for directors their family and their household.

To be trivial the benefit must cost less than £50 to provide, it cannot be cash or a cash voucher, this does not include store gift cards.

https://www.gov.uk/expenses-and-benefits-trivial-benefits

Staff Parties- There is an exemption for staff events that do not exceed a total of £150 per year.

https://www.gov.uk/expenses-benefits-social-functions-parties

Construction Industry Scheme (CIS)

Under CIS contractors deduct money from a subcontractor’s pay and pass it to HMRC. A contractor must complete a monthly CIS certificates (even when it is a nil return). Failure to submit the certificate by the monthly deadline can result in a £100 fine.

Contractor – A contractor is a business or other concern that pays subcontractors for construction work.

Contractors may be construction companies and building firms, but may also be government departments, local authorities and many other businesses that are normally known in the industry as ‘clients’.

Some businesses or other concerns are counted as contractors if their average annual expenditure on construction operations over a period of 3 years is £1 million or more.

Private householders aren’t counted as contractors so aren’t covered by the scheme.

When you’re about to take on and pay your first subcontractor, regardless of whether that subcontractor is likely to be paid gross or under deduction.

Subcontractor – A subcontractor is a business that carries out construction work for a contractor.

Subcontractors can apply to be paid gross – with no tax deductions taken from their payments. To do this, subcontractors will need to show us that they meet certain qualifying conditions.

A subcontractor must complete a tax return including the CIS which has been deducted from them that tax year to reclaim it.

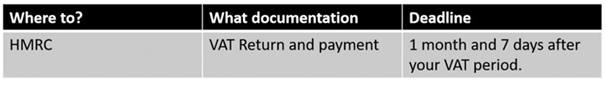

VAT

If your VATable turnover is more than £85,000 in a 12 month rolling period you will need to register for VAT https://www.gov.uk/vat-registration Most landlords letting domestic property are exempt.

If the existing business is VAT-registered, the VAT registration can be transferred to the new company so that the existing VAT number is retained. This can be done online via the trader’s VAT online account or by post on form VAT68. HMRC will normally transfer the VAT number within three weeks. The threshold for VAT registration is £85,000. Where all or most of your customers are VAT registered consider voluntary registration as your customers can reclaim the VAT you charge and you can reclaim the VAT on your expenses.

If you are not already using bookkeeping software now is a good time to update your bookkeeping system. We can train you up on QBO or VT or do the bookkeeping here for you.

Consider using “cash basis”. Also, have a look at the Flat Rate Scheme which may allow you to save some money on charging VAT.

Deadlines

Penalties

Defaults within 12 months | Surcharge if annual turnover is less than £150,000 | Surcharge if annual turnover is £150,000 or more |

2nd | No surcharge | 2% (no surcharge if this is less than £400) |

3rd | 2% (no surcharge if this is less than £400) | 5% (no surcharge if this is less than £400) |

4th | 5% (no surcharge if this is less than £400) | 10% or £30 (whichever is more) |

5th | 10% or £30 (whichever is more) | 15% or £30 (whichever is more) |

6 or more | 15% or £30 (whichever is more) | 15% or £30 (whichever is more) |

Deductible expenditure

As a general rule, a company can deduct expenses that are incurred wholly and exclusively for the purposes of the business and which are revenue in nature, in arriving at its taxable profits. However, there are some items for which a deduction is expressly prohibited for corporation tax purposes, and the accounting profit may need to be adjusted to take account of disallowable items.

Examples of expenditure include the costs of sales which are deducted to arrive at a gross profit. This will include stock movements, purchases, packaging, and distribution. Expenses are deducted from gross profits to arrive at net profit. Examples of allowable expenditure include:

• wages and salary costs;

• employer’s National Insurance;

• advertising;

• accountancy costs;

• office administration costs;

• travelling expenses;

• rent;

• business rates;

• insurance;

• benefits provided to employees;

• staff entertaining;

• interest and finance costs;

• repairs;

• legal fees;

• postage;

• printing;

• stationery; and

• utilities.

The above list is not exhaustive, and the deductible expenses will vary depending on the nature of the business. However, the key tests are whether the expense is revenue in nature and whether the expense is incurred wholly and exclusively for the purposes of the business.

Disallowable expenditure

Some categories of expenditure are specifically disallowed in calculating profits for corporation tax purposes. However, they may be deducted in working out the accounting profit. As accounting and corporation tax rules are not identical, it is necessary to adjust the accounting profit to add back the disallowable items to arrive at the taxable profit for corporation tax purposes.

One of the main disallowable items is depreciation, which is an accounting concept that must be added back in the corporation tax computation. The tax equivalent of depreciation is capital allowances, which provide relief for capital expenditure. Entertaining, other than staff entertaining, is also disallowed in the corporation tax computation and must be added back. A deduction is also denied for non-trade loans that are written off (such as a director’s loan), illegal payments (such as bribes), and fines for law-breaking, such as for breaching tax or health and safety legislation. However, motoring fines incurred by an employee while on company business can be deducted, but no deduction is allowed for fines received by a director, regardless of if they were received while the director was on company business. Items such as dividends (which are paid from post-tax profits) and the corporation tax paid by the company are not deducted in calculating taxable profits.

Pre-commencement expenses

The company may incur some expenses before it is active for corporation tax purposes in preparing to trade. This may include the buying of initial stock, advertising, hiring staff, preparing the premises, setting up a website, and suchlike. Where expenses are incurred in the seven years prior to the start of trading, relief is given for expenses to the extent that relief would be available if the expenses were incurred while the company was trading, i.e. to the extent that the expenses are revenue in nature and incurred wholly and exclusively for the purposes of the business. The expenses are treated as if they were incurred on the first day of trading, and relief is given in calculating the profits of the first accounting period.

What is Making Tax Digital (MTD)l?

MTD will affect every individual who is a taxpayer and every business in the UK. It will change the way that businesses keep their accounting records and report their income to HMRC, and the services that they need from their accountant or tax agent. The new regime will also offer the opportunity for self-employed taxpayers to pay their tax through optional “pay as you go” instalments, based on the data filed with HMRC under MTD.

Taxpayers will have to to adopt digital record keeping and make submissions to HMRC on a regular basis. HMRC’s ambition is to become one of the most digitally advanced tax administration in the world. MTD is a key part of this plan.

To be MTD compliant you must do two things; complete bookkeeping digitally and submit information to HMRC using appropriate software. We offer training in QuickBooks Online. You decide how much or how little you want to do; we do the rest.

VAT – Private tuition exemption -Once your turnover exceeds the VAT threshold (£85,000 pa from 1 April 2019) you will have to register for VAT and charge VAT on all your invoices. As your customers will not usually be VAT registered this effectively increases you charges to them by 20%.

There is a very important VAT break known as the “Private tuition exemption”. To qualify two conditions must be satisfied to exempt the supply:

The supply must be of a subject ordinarily taught in a school or university. If there is any doubt get evidence.

The service must be provided by an individual or partnership, independently of an employer. Limited companies will not qualify as the individuals working for the business are not independent of an employer.https://www.gov.uk/guidance/vat-on-education-and-vocational-training-notice-70130

Building and construction reverse

charge – From 1 March 2021 the domestic VAT reverse charge must be used for most supplies of building and construction services.

The charge applies to standard and reduced-rate VAT services:

• for individuals or businesses who are registered for VAT in the UK

• reported within the Construction Industry Scheme

https://www.gov.uk/guidance/vat-domestic-reverse-charge-for-building-and-construction-services#whentouse

https://www.youtube.com/watch?v=-FcmZlFcu6w

These new rules will apply to you if:

• You are VAT registered builder.

• You subcontract work out to other builders. For example, where a subcontractor invoices you and you (as the main contractor) then invoice the client.

• You invoice other builders for your services.

These new rules are being introduced to reduce fraud

The change is for VAT registered builder to VAT register builder transactions.

If you are the builder supplying the end customer, the builders sub-contracting to you will invoice you without charging VAT. You then invoice the end customer and charge VAT. The net effect is the same. For example, your subcontractor completes £1,000 of work for your and you add £1,000 of your work and invoice the customer.

The change is for VAT registered builder to VAT register builder transactions.

If you are the builder supplying the end customer, the builders sub-contracting to you will invoice you without charging VAT. You then invoice the end customer and charge VAT.

The net effect is the same. For example, your subcontractor completes £1,000 of work for you and you add £1,000 of your work and invoice the customer.

Pre 1 October 2020 procedure.

On your VAT Return:

Box 1 VAT on sales £400

Box 4 VAT on purchases £200

Box 5 VAT to be paid £200

Box 6 net sales £2,000

Box 7 net purchases £1,000

Your net receipt £1,000

From 1 March 2021 the new procedure is:

Subcontractor invoices you £1,000

You invoice your customer £2,000 plus £400 VAT

On your VAT Return:

Box 1 VAT on sales £400

Box 4 VAT on purchases £nil

Box 5 VAT to be paid £400

Box 6 net sales £2,000

Box 7 net purchases £1,000

Your net receipt £1,000

This type of procedure is referred to by HMRC as “reverse charge”.

Where you are the builder supplying another VAT registered builder you do so without charging VAT.

Transactions caught by the new rules.

Services and goods supplied to construction customers.

Supplies chargeable at 5% or 20%.

Transactions not caught by the new rules.

Supplies to non-construction customers.

Supplies to non-VAT registered customers.

Supplies of staff or workers.

Exempt and Zero-rated sales.

Businesses that are connected, e.g. a landlord and his tenant, two companies in the same group.

Other responsibilities – Subcontractor to main contractor.

You must ensure that the main contractor you are invoicing has a valid VAT number and is registered for the CIS (Construction Industry Scheme).

For further information see Section 9 of HMRC VAT Notice 735: Domestic reverse charge procedure

On your invoice you must include the wording “Customer to pay VAT under reverse charge procedure” and show whether the rate the main contractor must recharge is 5% or 20%.

Other responsibilities – Main contractor (who invoices end user customer).

You must make your VAT registered subcontractors aware the you are an “intermediary supplier” and that they should not charge you VAT under these new reverse charge rules. If you pay VAT incorrectly to your subcontractor HMRC may pursue you for the VAT.

You must identify the status of your end user customers. We recommend you ask your end user customers to sign a statement for each contract or include this in your terms of business. Contact Tax Data Ltd for the wording.

What else do you need to look at.

Consider if you can continue or if it is still tax efficient to use The Flat Rate Scheme and Cash accountancy, if you currently use these.

Are you/your staff up to identifying relevant contracts and end users affected by this?

Can your current bookkeeping system cope with the new invoicing and reporting requirements?

For subcontractors are the start of the supply chain you will still be claiming VAT on your expenses but not charging VAT on sales to main contractors. This may put you in a VAT repayment position. For cashflow purposes it may be beneficial to switch to monthly Returns.

Place of supply: goods

The place of supply of goods (POS) will decide the VAT treatment. Are they:

• UK based supplies

• Imports

• Exports

• EU dispatches, or

• EU acquisitions.

Generally, goods leaving the UK will have a UK place of supply, goods arriving in the UK will not have a UK place of supply. Exports leaving the EU, are zero rated. Imports, goods arriving from outside the EU become VATable for the purchaser.

EU supplies to other EC member states are Zero rated for customers with an EU VAT registration number or VAT is charged at the normal rate for customers with no EU VAT registration.

EU acquisitions from EC states are Zero rated by the supplier if you provide them with your VAT number. You then account for VAT on the acquisition using box 2 on your VAT return. If you are not VAT registered, VAT is charged at the supplier’s local VAT rate.