- Home

- Services

- Meet the Team

- Help & Advice

- Useful information

- Companies

- Expenses for directors

- Travel

- Car Benefit

- Buying or Leasing

- Closing a Trading Company

- Capital Distributions on Winding Up

- Non-Trade Income

- Cash Surplus on Balance Sheet and Effect on Trading Status

- Trading Company – Definition

- Company Losses

- Share Structure

- Selling Assets to the New Company

- Super-Deduction

- Payroll

- Penalties

- The Contract Employment Status Tool (CEST)

- The Employment Status Indicator (ESI)

- Benefit in Kind

- Construction Industry Scheme (CIS)

- VAT

- Deadlines

- Penalties

- Deductible Expenditure

- Disallowable Expenditure

- What is Making Tax Digital (MTD)?

- Place of Supply: Goods

- Accounts

- Cash Basis

- Accruals Basis

- Expenses you can claim Entertaining And Gifts To Employees\Directors

- Entertaining

- Gifts Over £50 to Staff

- Gifts to Customers and Suppliers

- Free Food and Drink

- Staff Meetings and Training

- Motor Expenses

- Interest on Car Loans

- Mileage

- Actual Costs – Running Expenses

- Buying or Leasing

- Ownership

- Vans

- Travel

- Accommodation

- Subsistence (Food and Drink)

- What Can I Claim For “Use Of Home”

- Gifts And Donations

- Rental & Holiday Lettings

- Trading And Property Allowances

- What is a Furnished Holiday Letting (FHL)?

- Property Ownership

- Unmarried Owners

- Married Couples and Civil Partners – Joint Ownership

- Partnership

- Keeping Records

- Expenses

- Capital Outgoings and Recent Changes

- Capital Gains

- Repairs/Capital improvements

- Capital Gain

- Pay Capital Gains Tax in 30 Days

- Here are Some Terms you should be Aware of

- Entrepreneurs’ Relief (ER)

- Separation

- Contact

Help & Advice

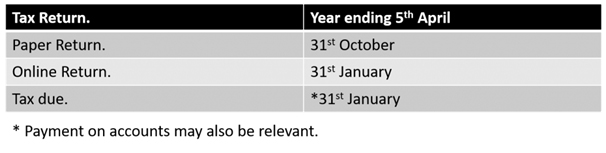

Deadlines And Penalties - Self-assessment

You will be charged £100 for missing the initial deadline, Further penalties will be applied if your tax return is more than 6 months late.

You will also be charged interest and penalties for late payment.

https://www.gov.uk/estimate-self-assessment-penalties

You can appeal against penalties providing you have a reasonable excuse.

Tax Rates& Thresholds

https://www.gov.uk/income-tax-rates